How I Made My First 100K at 25 & The Money Principles That Made It Possible

“I saw something else under the sun: The race is not to the swift, nor the battle to the strong; neither is the bread to the wise, nor the wealth to the intelligent, nor the favor to the skillful. For time and chance happen to all.”

The turning point came when I decided to stop Passing Over Opportunities Repeatedly. Instead, I chose to see and grab every opportunity, build deliberate habits, and stick to clear financial goals.

At 25, this mindset manifested in a net worth of 100K.

Here’s exactly how I did it and the practical money principles I learned along the way.

Ask Better Questions

Like many young people, I used to spend my entire paycheck as soon as it came in. Saving? Investing? Those were ideas for “later.”

Everything changed when I started asking myself better questions:

- How can I make more money?

- How can I make my money grow, instead of letting it sit in the bank?

I discovered that to make more money I needed to game up my skills. By focusing on high income generating skills I was able to start side hustles - which I speak into shortly. Furthermore, these questions led me to one of the best financial literacy book: “The School of Money” by Olumide Emmanuel. It opened my eyes to the basics of personal finance, financial management, and multiplying money.

💡 Principle: Your answers are only as good as your questions. If you want wealth, start by asking the right questions and then ACT on the answers.

Learn to Multiply Money

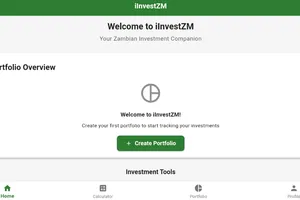

A major turning point came when a colleague at work introduced me to the stock market, buying and selling shares on the Lusaka Stock Exchange LuSE in Zambia.

I opened my first brokerage account and made my first investment. I was so excited that I sold my iPhone 11 Pro and invested almost all the money I had at the time, about ZMW 19,500 into one stock. Six months later, that investment grew to ZMW 28,000.

I sold those shares, added more savings, and bought another stock for ZMW 30,400. Just two weeks later, that investment doubled to ZMW 58,000. What some might call “beginner’s luck” was, for me, a door into real investing.

Yes, I made some rookie mistakes like selling too soon but every trade taught me something: how to read financial statements, how to choose businesses I believed in, and how to let my money grow.

If I’d held on longer, my ZMW 30,400 investment would be worth ZMW 66,000+ as at this article in that stock alone, but I have no regrets. The lessons were worth every kwacha.

💡 Principle: Saving is good. Investing is better. Learn how to grow your money and let compounding do its work.

Spend Less Than You Earn

No matter how much you earn, if you spend it all, you’ll stay broke.

One of my best decisions have made, is to delay moving out. Even now, I stay at my uncle’s place instead of renting my own, even though I can afford to. That sacrifice has saved me rent, utilities, and lifestyle costs and that money always go straight into my investments.

If you can and you are fortunate enough to have a generous family. Don't rush, give yourself a timeline to build a solid foundation before taking on new expenses.

💡 Principle: Live below your means. Save and invest first then spend what’s left, not the other way around.

Build Multiple Streams of Income

Your salary alone won’t make you rich but your skills can.

I looked at what I could do software development and turned it into a side hustle. I took every freelance job I could get, no matter how small. Every bit of extra income was invested first and spent later.

Over time, my side gigs made up a huge part of my 100K journey.

💡 Principle: Don’t rely on one paycheck. Use your skills to create more income streams. Every extra coin invested is fuel for your financial goals.

Let Compounding Do the Heavy Lifting

All these choices; asking better questions, investing early, spending wisely, earning more, only paid off because I was consistent.

I didn’t stop after one trade or one paycheck. I kept going, month after month, watching small amounts grow into bigger amounts. That’s the magic of compounding: time turns small, smart moves into serious money.

💡 Principle: Start early, stay consistent, and let time and compounding grow your wealth.

Final Thoughts: Start Now

I’m not a financial guru, just someone who decided not to pass over opportunities repeatedly.

If you take away anything from my story, let it be this:

✅ Get obsessed with learning about money.

✅ Sacrifice short-term comfort for long-term freedom.

✅ Read books like "The Richest Man in Babylon"

✅ Take action, stay patient, and watch the seeds grow.

Your first 100K is closer than you think - but only if you start now.

Donate

Donate